Win With Branch, Don't Settle For DailyPay

Don't fall for risky practices like wage assignment, used by competing on-demand pay providers. Branch aligns with state regulations through a standard deduction model. Plus, our solution comes at zero-cost, with no fees or interest, and seamlessly integrates with existing payroll systems.

The Branch Advantage

| Branch | DailyPay | |

|---|---|---|

|

|

|

|

| Free for employers & employees | ||

| No need to switch direct deposit | ||

| EWA model aligned with CFPB opinion | ||

| Complies with state laws regarding direct deposit | ||

| 24/7 live customer support | ||

| 90-second onboarding for employees | ||

Branch

Short pricing description goes here.

-

Free for employers & employees

-

No need to switch direct deposit

-

EWA model aligned with CFPB opinion

-

Complies with state laws regarding direct deposit

-

24/7 live customer support

-

90-second onboarding for employees

DailyPay

Short pricing description goes here.

-

Free for employers & employees

-

No need to switch direct deposit

-

EWA model aligned with CFPB opinion

-

Complies with state laws regarding direct deposit

-

24/7 live customer support

-

90-second onboarding for employees

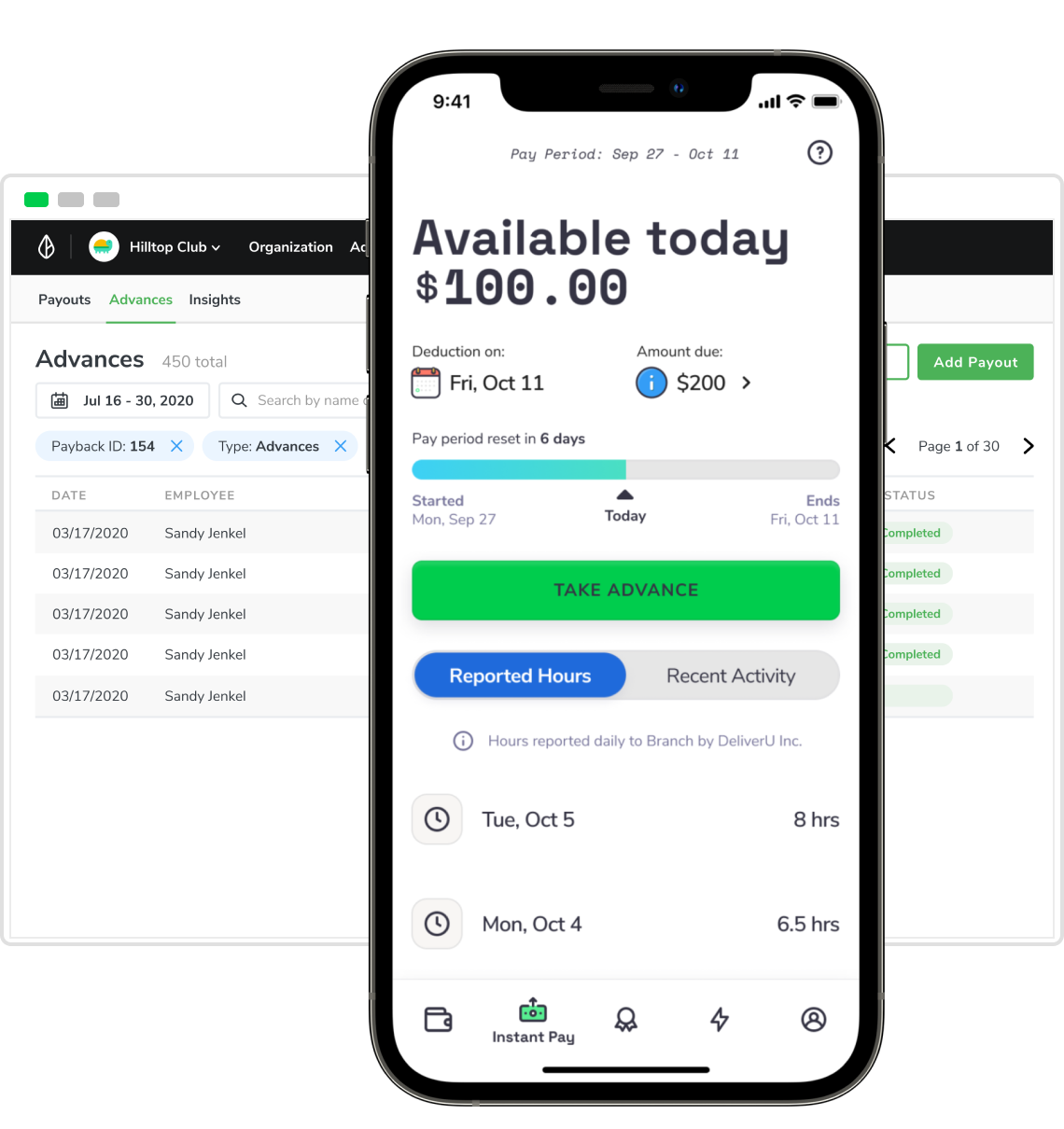

#1 On-Demand Pay Provider

Designed For Responsible Use

Our model is set up so employees treat this offering responsibly and keep you & your employees financially safe. We allow them to take up to 50% of their earned wages ahead of time if needed, but you get to set the limits.

The Original Fee-Free EWA

Workers pay zero fees to access the money they’ve earned. This includes free ATM access within the Allpoint Network, zero overdraft fees, management fees, inactivity fees, or minimum balance requirements.

No Pre-funding, Escrow, or Third-Party Risk

Unlike other EWA providers, we use our capital to grant your employees their earned wages—you don’t have to. There’s no pre-funding or escrow required on your end.

Grab the 2-Page Branch EWA Overview ↓

Pay-tential that could be yours

User-focused

Delight your workers with a rewarding app experience, while making the lives of admins easier with our PayAdmin portal.

Effortless deployment

Start paying employees on day one, with simple processes, and dedicated customer success teams.

Zero-cost

Branch's comprehensive suite of payment tools come at no cost to you or your employees.

Employers love us...

.png)

"Our biggest reason for going with Branch was the lack of fees. I looked at a lot of different paycard type solutions, and there are some ridiculous fees. If you breathe on your card, there's a fee, and we didn't feel that was fair to our team members."

Keith Mungo

New River Valley Domino’s

500+ organizations use Branch to empower their workers

FAQs

Q.

How much does this cost?

Branch is free for you and your employees. We charge zero fees to access funds, including zero overdraft fees, management fees, and inactivity fees, and there are no minimum balance requirements.

Q.

Are you available in all 50 states?

Yes, we are! The way we set up our direct deposit pullback does vary slightly depending on which state you are in. We stay up to date with all the latest state regulations to make sure we tailor our approach to your specific state regulations.

Q.

Will my employees overuse this feature?

We’ve found that it’s not the same employees using this feature from one pay cycle to the next, indicating that they use it for specific unexpected expenses, like a medical bill or car repair. Plus, since they are only accessing wages they’ve already earned (and Branch is responsible for providing this capital); you don’t take on unnecessary risk. We also have guardrails in place (detailed in the next question) that prevent your employees from advancing more than 50% of their upcoming paycheck.

Q.

How much control do I have over EWA frequency and amount?

You can allow a maximum access of up to 50% earnings, but you can set a lower amount if you want. The average employee only takes about $70 ahead of payday, indicating EWA truly does go to needed expenditures and emergencies.

Q.

The Consumer Financial Protection Bureau (CFPB) recently outlined how EWA providers must work with employers. Do you follow these guidelines?

Yes, our employer-based EWA business model aligns well with the CFPB's advisory opinion. We recover the amount of each EWA transaction through an employer-facilitated payroll deduction from the employees’ paycheck.