The Modern Financial Solution Leading Enterprises Are Offering To Increase Employee Financial Stability, Reduce Turnover Costs, and Attract New Talent

Chapters in this guide

Thanks for checking out the Ultimate Guide to EWA: The Modern Financial Solution You Should Be Offering Your Employees. My name is Atif, and I’m the CEO and founder of Branch.

Branch is filling the gap for low-income working Americans that are underbanked or unbanked, by providing transparent and equitable financial services.

In this guide, I dive into the world of Earned Wage Access (EWA) and cover why it’s the new, modern financial solution you should offer to your employees.

By definition, Earned Wage Access or EWA breaks up the weekly, bi-weekly, or monthly pay cycles so workers can receive money that they’ve already earned before payday.

Below is an overview of what I cover in each chapter — so that by the end, you’ll have a better understanding of how EWA can empower your employees.

In this guide:

Looking forward to diving into this with you!

Atif

As employers ramp up their financial wellness benefits in 2020, they’re figuring out what solutions are truly going to resonate with employees.

Among these genuinely useful benefits is EWA: one of the most talked-about and increasingly popular benefits.

Let’s go beyond the lip service and look at what EWA actually means.

Financial stress can affect every area of life, including the workplace. In many cases, stress from situations outside of work — such as upcoming or late bills — can cause employees to perform poorly. “If only payday were a little sooner,” they might think.

But what if payday could come a little sooner? What if employees could access the wages they’ve already earned but not received yet, simply due to pay schedules?

They might just…While each of these results is a direct benefit to employees, there’s a benefit for employers, too. Because EWA creates a workforce that’s better able to focus on doing their best work.

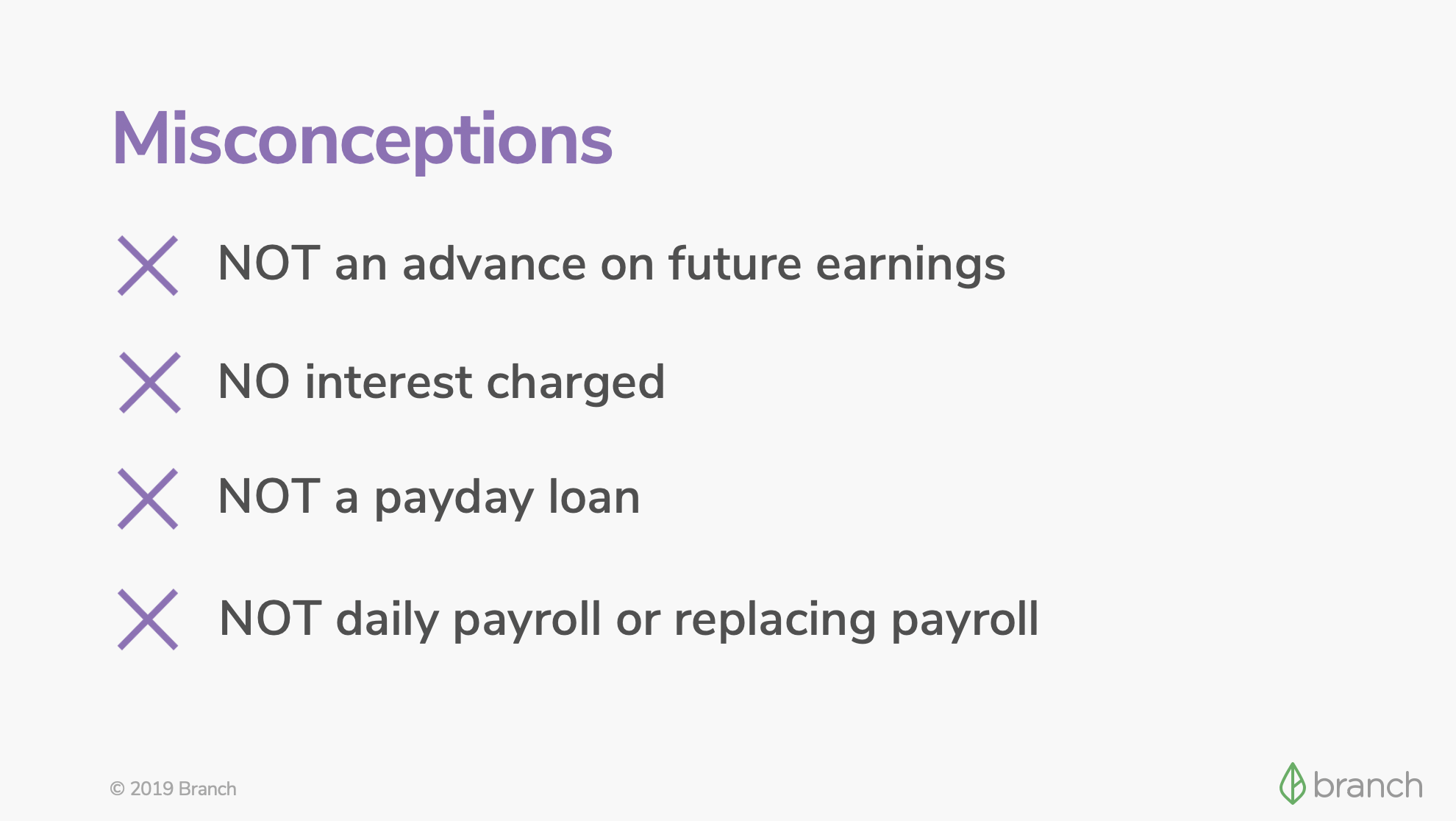

Before we continue, it’s important to discuss what EWA is not.

EWA is NOT a payday loan. Nor does it charge interest on funds accessed early.

EWA is NOT meant to put users into a cycle of loans but offer a safe alternative can avoid them. Among the businesses who’ve implemented EWA, we’ve seen only about 15-20% of employees take an advance on their earned wages each month and they’re typically not the same employees.

And, EWA is NOT difficult to set up. It’s a way for your business to solve key personnel issues.

While EWA gives your employees financial peace of mind and stability, it also complements other benefits.

Branch’s mobile-first app helps employees manage cash flow, anticipate upcoming recurring bills, and get more insight into how much they make.

Plus, integration with scheduling solutions like Kronos allows employees to self-select additional shifts right from the app.

This, combined with other benefits, results in:

The traditional “paycheck every two weeks” model might seem fine because it’s so common. But when we take a step back, several key disadvantages appear.

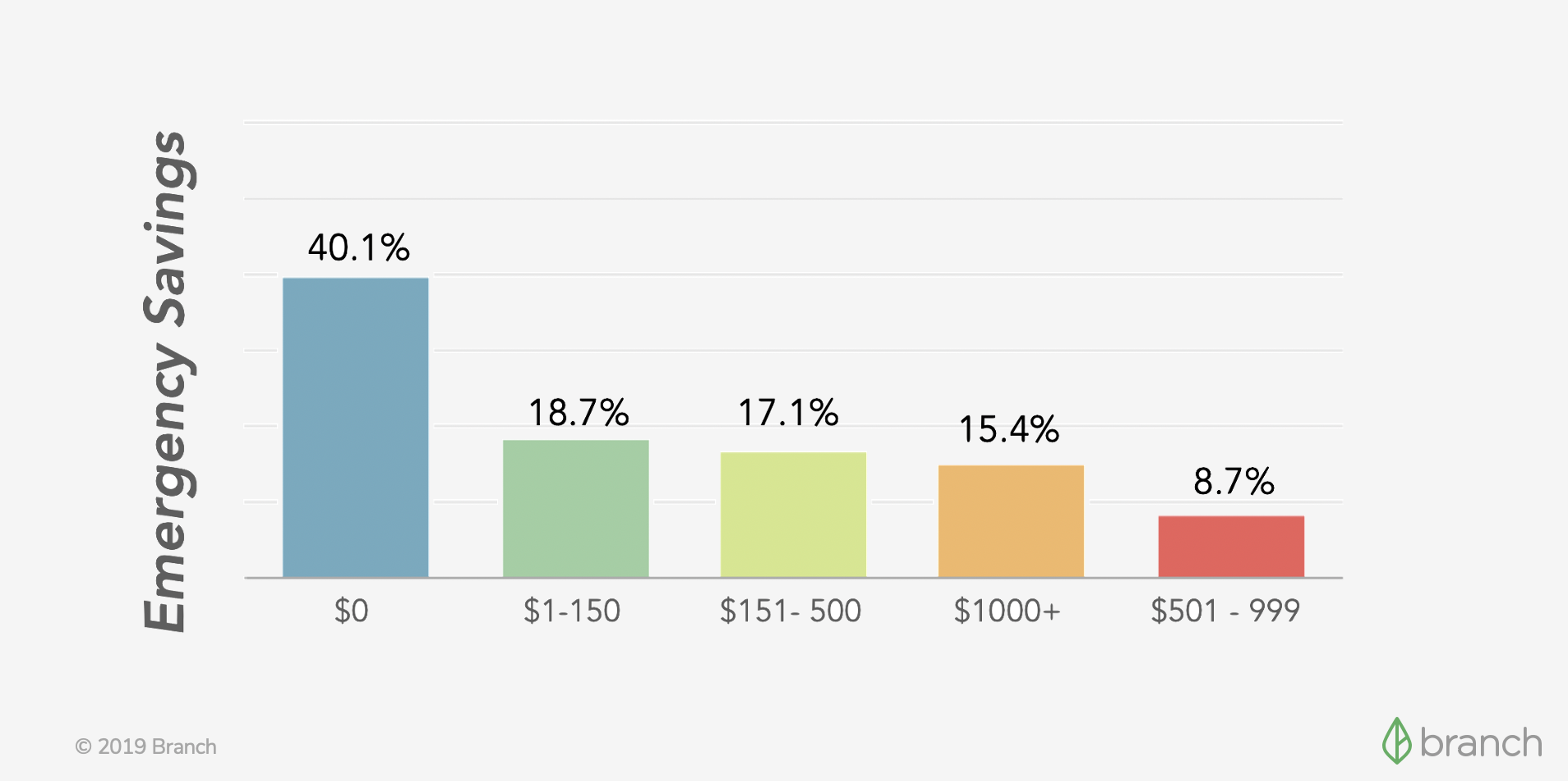

First, most hourly employees live on a paycheck-to-paycheck basis. At least 40% of hourly employees have no savings whatsoever, and 75% have less than $500 saved. (The Branch Report)

Plus, due to weekly variations on hours worked, actual paycheck amounts fluctuate. This makes it much harder for this group to predict their income (AKA it’s nearly impossible to budget).

Finally, unlike the middle class, hourly employees often have little or no access to credit. Our data shows 84% of them rely on debit cards and cash to make everyday purchases.

All of this means many of your hourly employees still struggle with their finances, no matter what financial gains they may be making.

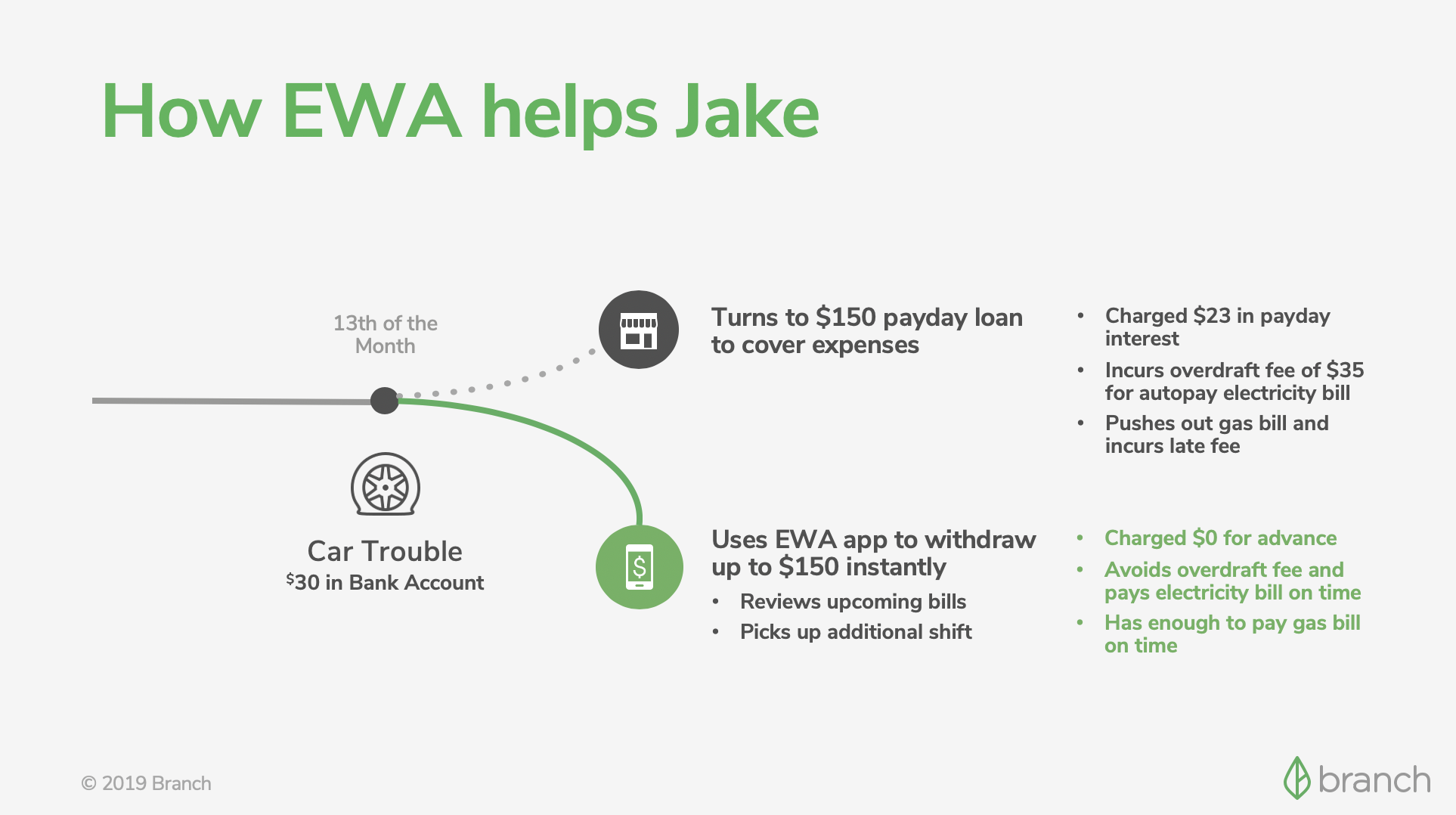

Let’s look at a real-world example of EWA in action.

An hourly employee (let’s call him Jake) knows he makes approximately $1200 per paycheck. But after receiving his last paycheck — which he spends on monthly rent, cell phone bills, and food — he learns his car needs a minor repair.

Jake simply doesn’t have the cash to make the repair — but he needs his car in order to get to work. Prior to his company’s EWA program, he would have turned to a payday loan to get the repair cash… and entered into a destructive cycle of high-interest loans to pay off high-interest loans for years.

Sounds stressful, right? Naturally, Jake’s work performance would be affected. He might miss work sometimes, or quit altogether.

But his company offers EWA through Branch. Instead of taking out risky, expensive debt, Jake can instead instantly access the wages he’s already earned. (continued)

Now, Jake can pay for his car repair and continue showing up for shifts. In fact, thanks to the Branch app, it’s easy for him to pick up additional shifts. When it’s payday, the wage amount he accessed in advance is automatically deducted from his paycheck.

It’s a smarter, smoother way to access earned wages. And it’s an effective way to turn a potential emergency into a simple, stress-free scenario. Business as usual.

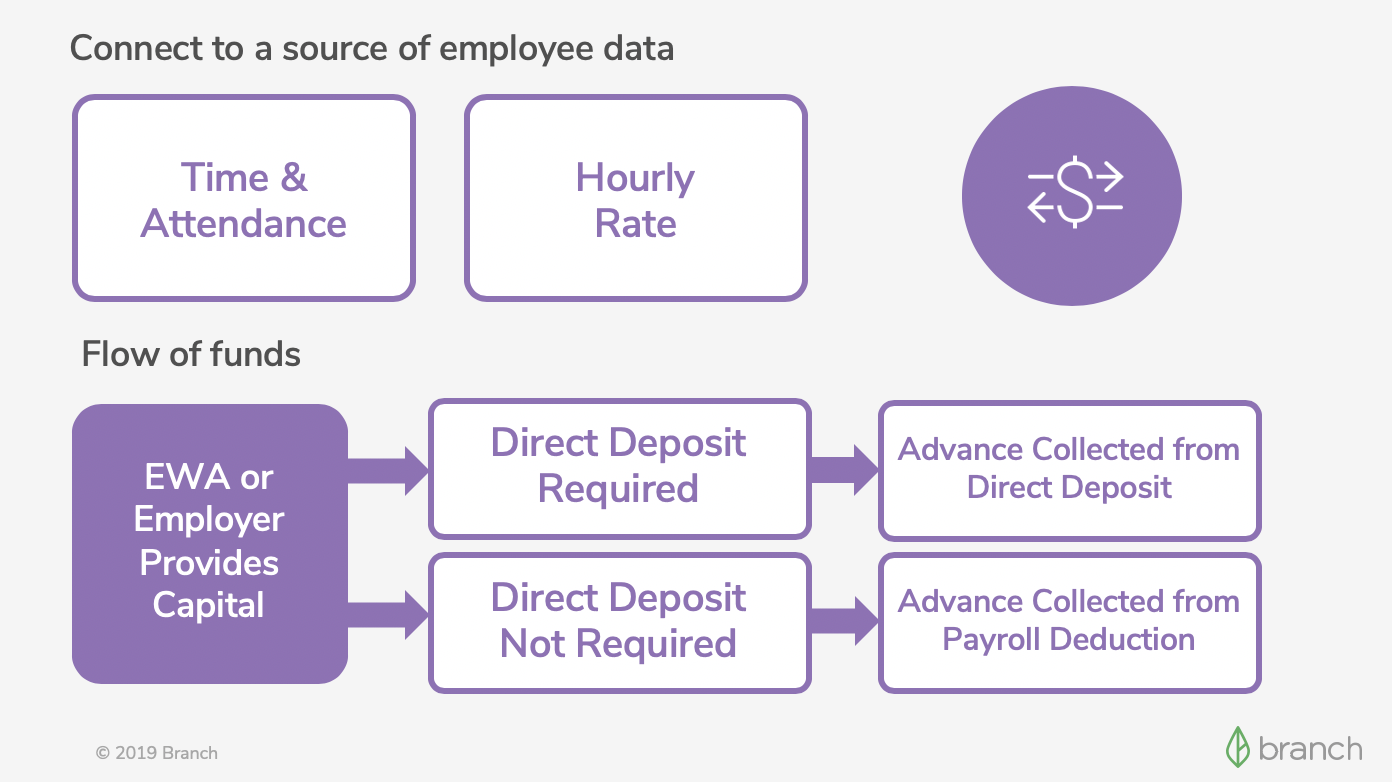

Now that we’ve gained an understanding of what Earned Wage Access (EWA) is and why it’s important, let’s review how EWA with Branch actually works.

Setting Up EWA For Your Business Is Simple Thanks to integrations with major workforce software, implementing EWA via Branch can be remarkably fast and simple.

Businesses don’t need to manually enroll each employee to Branch. You only need to submit a list of eligible employees, and Branch takes care of the rest.

Setup is fairly quick! How long it takes your business will depend on how easy it is for you to access the necessary time & attendance data and employee information. (Again, Branch integrates with major time and attendance systems like Kronos and Delaget, so that can make the process even easier.)

And though we gladly offer training sessions for employers and for employees, Branch is designed to be extremely intuitive and easy-to-use.

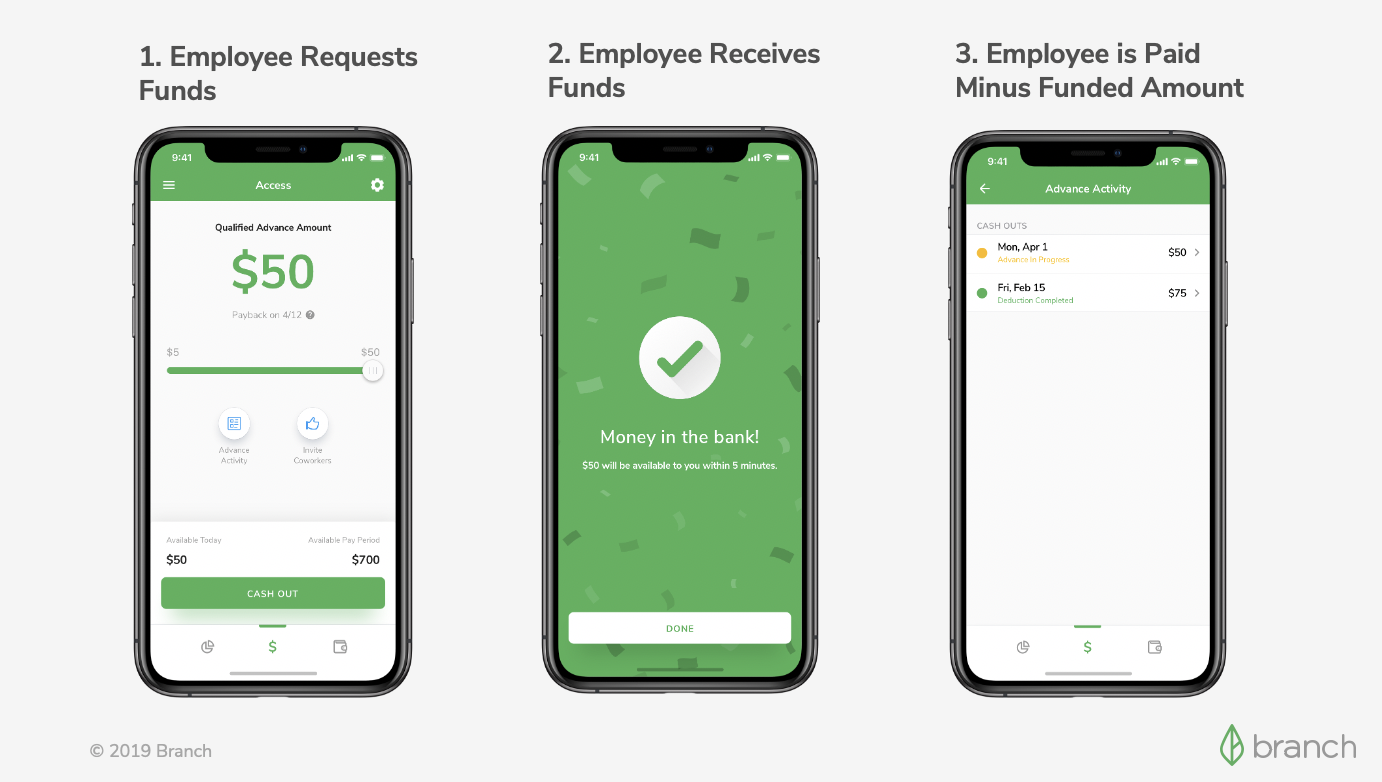

Once your business is offering EWA with Branch, your employees can easily access their earned wages.

Here’s how it works:

In a few simple steps, employees can access wages they’ve already earned and alleviate financial stress.

Some employers may ask, “Do employees tend to abuse EWA and get caught in similar traps as payday loans?” Based on our data, only 20% of employees use EWA and they’re not usually the same employees each month. Additionally, the average EWA amount is only $70.

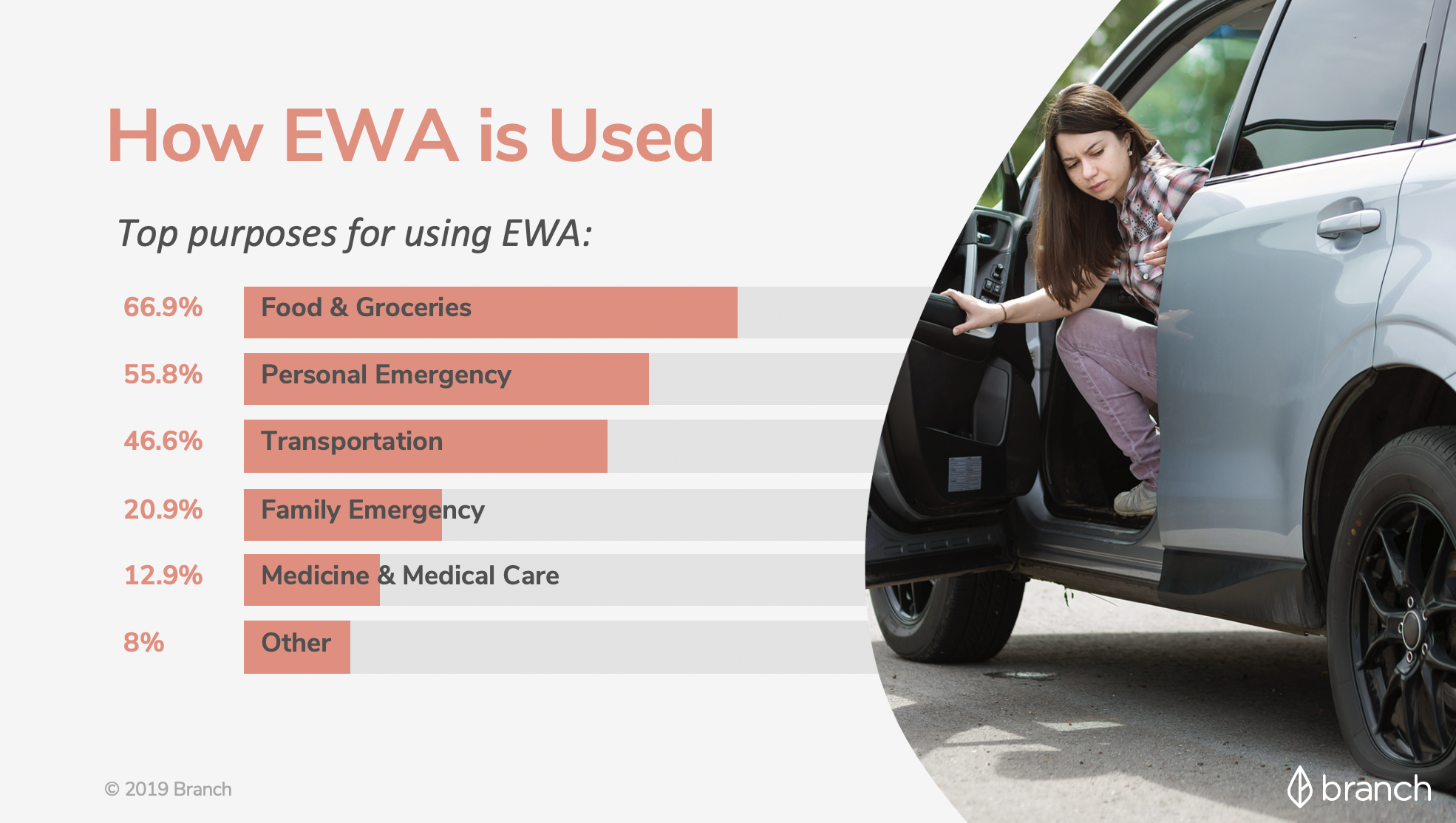

This points to employees using EWA the way it’s intended: to solve short-term financial stress (such as unexpected and day-to-day expenses).

Again, it’s important to understand what EWA is not:

With EWA from Branch, your company can offer a responsible, effective way to promote longterm financial wellness amongst your employees.

How is this free for employees and employers?

When employees start using Branch, they receive an optional debit card. Every time employees use these cards to purchase something, there’s a small merchant transaction fee (just like credit card processors like Visa and Mastercard charge). Employees can move their funds from the Branch debit card to other accounts at any time.

Do employees actually use EWA to address unexpected expenses?

We’ve seen that only about 15-20% of employees use EWA, and that usage tends to happen when something unexpected comes up. We don’t see a cycle of the same people using our service over and over again, in the way most people use payday loans. Most use EWA for basic living costs such as food/groceries (66.9%), or transportation (46.6%).

How much control do employers have over EWA frequency and amount in a given time period?

With Branch, employers have a lot of control. Most employers allow a maximum access of up to 50% of earned wages. The average employee only takes about $70, indicating EWA truly does go to needed expenditures and emergencies.

Do employees have to pre-register or qualify?

Once an employer is signed up for Branch, the requirements for eligibility are based on whether the employee is active and how many hours were worked during a given pay period.

In the next chapter, we’ll cover how EWA fits into other financial wellness programs.

Most employers approach financial wellness benefits to help them achieve long-term goals. For example, employers may offer Health Savings Accounts (HSAs) or matching 401K accounts.

But these offerings have limitations and restrictions that leave a gap for addressing short-term financial health and needs. Employers and employees alike are missing out on key benefits.

Financial wellness programs that help address short-term financial needs can result in 60% increased shift coverage

If employees can access earned wages early, common barriers to showing up at work (including the cost of transportation or unexpected emergencies) aren’t as pressing. Employees can simply access their wages a little bit early if something comes up, allowing them to continue business as normal.

Plus, Branch’s app includes a way for employees to pick up additional shifts when needed. This saves your managers time having to manually contact each employee and wrangle availability. Employees are happier they have more control over shifts, and you’re happy to have a fully staffed shift.

Compared to companies without a financial wellness program, businesses offering EWA as a benefit can experience up to 60% increased shift coverage.

EWA can decrease employee turnover by up to 25%

EWA is popular among hourly workers and other employees living paycheck to paycheck. So popular, in fact, that many of the most reliable hourly workers know they don’t have to work for a company that doesn’t offer it.

When employees feel they have control over their financial future, they feel confident in thinking about their long-term success with a company. This makes them more likely to stay — about 25% more likely, in fact.

EWA doubles your company’s attractiveness to applicants!

In our current economic climate, finding the right employees for hourly jobs is harder than ever.

Along with helping retain talent, EWA and other financial wellness programs also help attract applicants.

Listing EWA as a benefit in a job description is a proven way to double applicants, giving you a greater body of qualified potential hires to choose from. Employers we work with have reported seeing an increased volume of applicants after updating their job descriptions to include earned wage access.

It’s clearly a smart move for businesses to offer EWA to complement other financial wellness programs.

But how do you implement a successful financial wellness benefit? That’s what I’ll cover in the next chapter — the final chapter in our guide.

In this guide, so far we’ve covered…

Now I’ll show you how to bring it all together — and what should be on your mind when you’re considering rolling out an EWA.

If the previous chapters have convinced you to offer EWA to your employees, then you’re probably wondering how you can implement it successfully.

It’s helpful to consider the following factors:

1. What will benefit employees most? The customizability of EWA access — including how much funding can be accessed and how often — lets you consider the best way to benefit your employees. Scheduling integration may be another benefit that fits your business needs.

2. Differences among providers. Choosing an EWA provider (like Branch) that can serve your business and its employees is critical.

3. Pricing & business model. Since you’re trying to promote financial wellness, selecting a provider that doesn’t charge interest or fees to your workers is important. Branch has aligned its business model with the growth of its users, rather than trying to monetize and perpetuate repeated advances.

4. Support building healthy financial habits. Finally, know that financial wellness is not just one solution, but an entire support system. This means you should choose a provider who wants to bring big-picture financial wellness to your employees, where options like EWA are supplemented with things like budgeting tools.

Once you’ve considered these things, make a plan for organizational adoption. This will ensure your EWA implementation feels like a big win for your team.

First, make sure there’s enthusiasm and buy-in for the financial wellness program from the topdown. Every level of management should be on board.

Next, leverage manager relationships with employees to have discussions, one-on-one, about how the financial wellness program benefits individual employees.

Finally, grow awareness of the program both internally and externally. Inform current employees of their new options. Make an explanation of the benefit an important step of new employee onboarding. And mention the benefit in your recruiting.

Oh, and one more thing – make sure you’re leveraging a mobile-first technology. Income does not affect smartphone ownership, so it’s likely your hourly workers all use mobile devices. A native mobile app like Branch will deliver a smooth, enjoyable experience for your employees.

If you want help implementing a financial wellness program, we’re here to help. Reach out, and we’ll happily answer your questions.

Congrats on making it through the Ultimate Guide. What did you think of it?

I hope the guide has helped shed more light on how your business can benefit from offering your employees a new, flexible way to access their wages.

In a nutshell, offering Earned Wage Access and related benefits means…

Now that you’ve completed the guide, I want to invite you to learn how to get started offering EWA to your employees sooner rather than later — all for free.

The Branch App is a free voluntary benefit that can help eliminate the cycle of financial hardship, debt, and stigma that often goes unseen in the workplace, yet is often dramatically reflected in employee performance.

Get the complete guide to Earned Wage Access sent directly to your email.